By signing in or creating an account, you agree with Associated Broadcasting Company's Terms & Conditions and Privacy Policy.

By signing in or creating an account, you agree with Associated Broadcasting Company's Terms & Conditions and Privacy Policy.

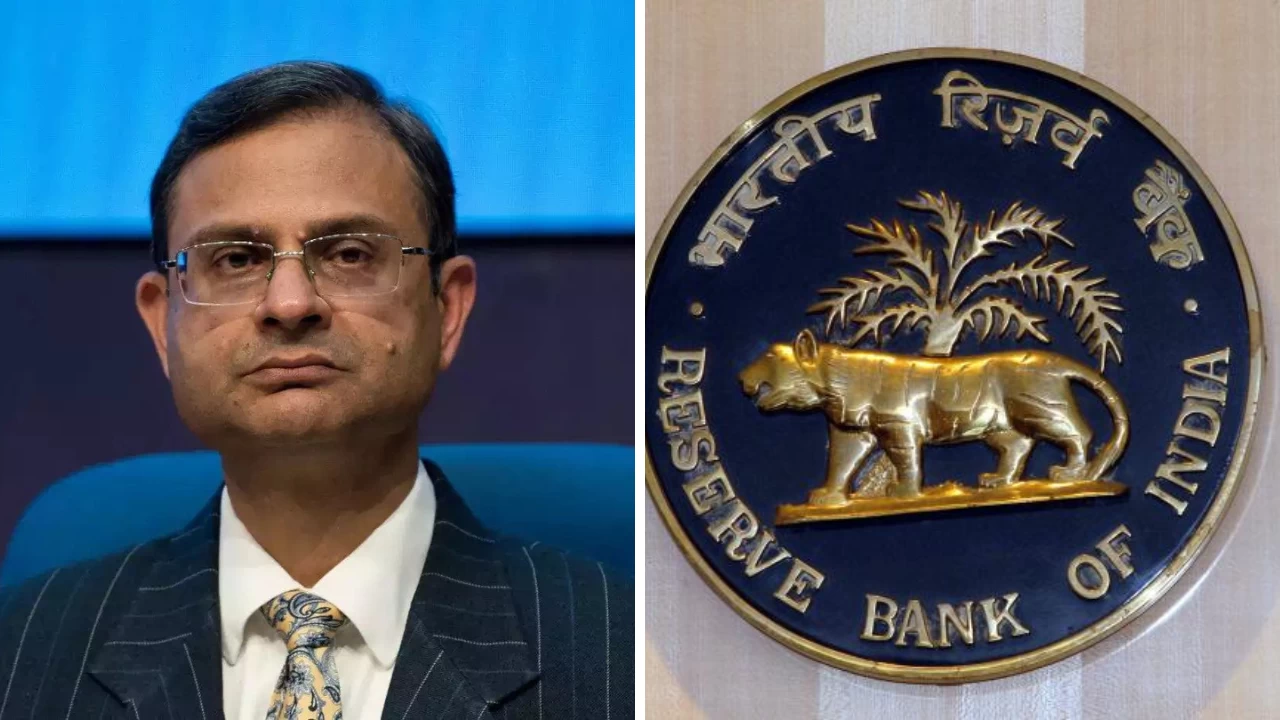

New Delhi: Reserve Bank of India (RBI) Governor Sanjay Malhotra said in an interview to a private news channel that there is scope for further reduction in the policy rate cut. Malhotra said that in the last MPC (Monetary Policy Committee) meeting held in October, it was clearly stated that there is scope for policy rate cuts. He further said that since then, the macro economic data we received have not indicated that the scope for interest rate cuts has decreased. There is certainly scope (to reduce rates), but whether the MPC takes any decision on this in the forthcoming meeting or not is up to the committee.

The MPC cut interest rates by a total of 100 basis points in 2025 so far. Members of India's interest rate panel indicated that there is scope for interest rate cuts in the future. Inflation in the country is decreasing, as evidenced by the details of the October meeting. India's retail inflation fell to a record low of 0.25 percent in October, which was caused by a sharp fall in food prices and tax cuts on consumer goods, which cleared the way for the central bank to cut interest rates in December.

India's 10-year benchmark bond yield declined slightly following the governor's comments. However, despite economists expecting interest rate cuts at the next policy meeting, overnight indexed swap rates — the closest scale of market expectations on policy rates — were indicating the status quo. Malhotra also said that the recent fall in the Rupee is natural and although the RBI intervenes to control excessive volatility in the currency, the annual fall in the rupee of 3-3.5 percent is in line with the historical average.

The Rupee fell to a record low of 89.49 on Friday, driven by concerns over portfolio withdrawals and trade disputes with the US. It has lost a little over 4% this year, and it is one of the worst performing Asian currencies.