By signing in or creating an account, you agree with Associated Broadcasting Company's Terms & Conditions and Privacy Policy.

By signing in or creating an account, you agree with Associated Broadcasting Company's Terms & Conditions and Privacy Policy.

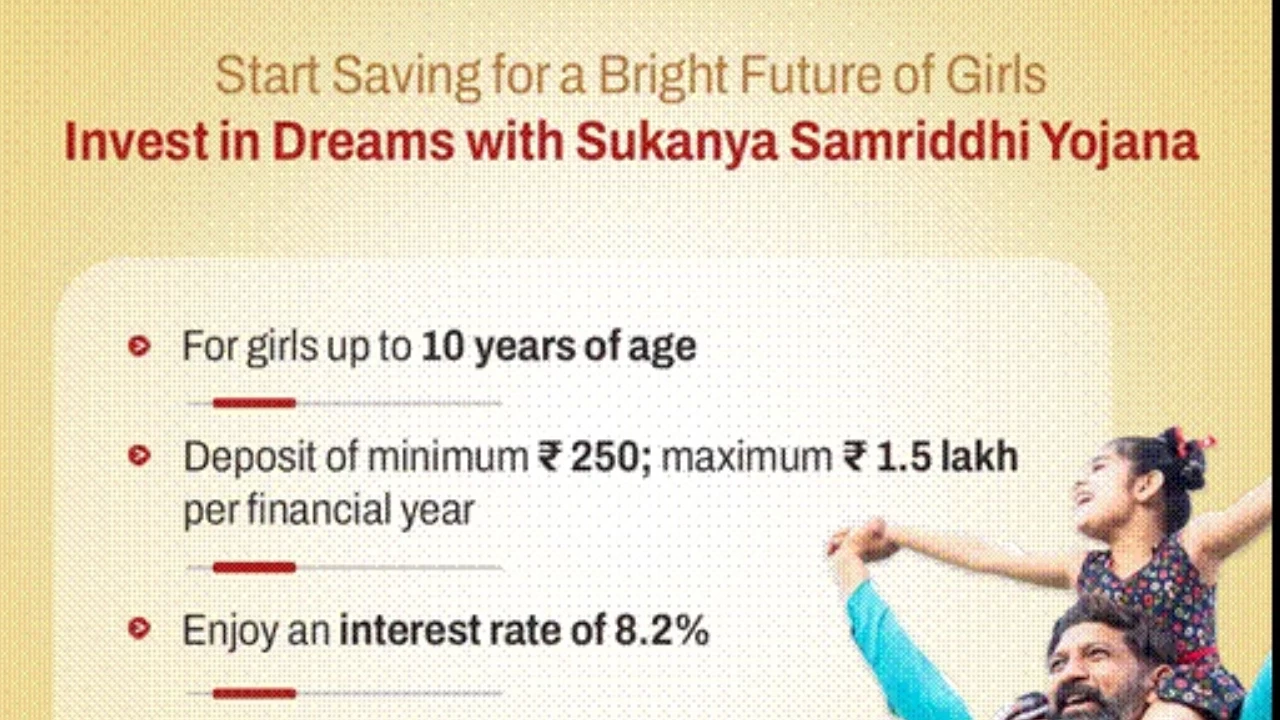

Ever since its launch on January 22, 2015, Sukanya Samriddhi Yojana (SSY), has been a hot favourite scheme of parents who have a girl child. The SSY scheme encourages families to invest in the bright futures of their daughters. It is a government-managed long-term investment scheme which assures guaranteed returns. A guardian is allowed to open the account immediately after the birth of the girl child till she attains the age of 10 years.

Sukanya Samriddhi accounts for girls can be opened at any Post Office or designated commercial bank branch. The government has fixed the minimum deposit amount at Rs 250 in a financial year. The total annual deposit limit is capped at Rs 1,50,000. Deposits are allowed to be made for a period of up to 15 years from the account opening date. The account matures upon the completion of 21 years of the account holder from its opening date.

Let’s take an example of an account in which a guardian deposits 1,50,000 every financial year for 15 years. By the end of the 15-year deposit period, the total deposited amount will be Rs 22,50,000. If we consider the existing interest rate, which is 8.2 per cent, then the beneficiary will get a maturity amount of Rs 71,82,119, out of which interest will be Rs 49,32,119.

Besides providing a financially secured future for the girl child, the Sukanya Samriddhi Yoajan also provides Income Tax benefits. The SSY deposit is eligible for deduction under Section 80-C of Income Tax Act. The interest earned in the account is free from Income Tax under Section -10 of I.T. Act.

| Financial Year | Amount Deposited (₹) | Interest Earned (₹) | Year End Balanced (₹) |

|---|---|---|---|

| 1 | 150000 | 12300 | 162300 |

| 2 | 150000 | 25608.6 | 337909 |

| 3 | 150000 | 40008.51 | 527917 |

| 4 | 150000 | 55589.2 | 733506 |

| 5 | 150000 | 72447.52 | 955954 |

| 6 | 150000 | 90688.21 | 1196642 |

| 7 | 150000 | 110424.65 | 1457067 |

| 8 | 150000 | 131779.47 | 1738846 |

| 9 | 150000 | 154885.38 | 2043732 |

| 10 | 150000 | 179885.99 | 2373618 |

| 11 | 150000 | 206936.64 | 2730554 |

| 12 | 150000 | 236205.44 | 3116760 |

| 13 | 150000 | 267874.29 | 3534634 |

| 14 | 150000 | 302139.98 | 3986774 |

| 15 | 150000 | 339215.46 | 4475989 |

| 16 | 0 | 367031.12 | 4843020 |

| 17 | 0 | 397127.68 | 5240148 |

| 18 | 0 | 429692.15 | 5669840 |

| 19 | 0 | 464926.9 | 6134767 |

| 20 | 0 | 503050.91 | 6637818 |

| 21 | 0 | 544301.08 | 7182119 |