By signing in or creating an account, you agree with Associated Broadcasting Company's Terms & Conditions and Privacy Policy.

By signing in or creating an account, you agree with Associated Broadcasting Company's Terms & Conditions and Privacy Policy.

New Delhi: Tesla’s next-generation AI chips will be manufactured by Samsung Electronics in the United States under a massive $16.5 billion (₹1.43 lakh crore) chipmaking deal that could revive the Korean firm’s struggling foundry business. The chips, named AI6 (Ai-6), will power future Tesla hardware and are expected to be produced at Samsung’s upcoming plant in Taylor, Texas.

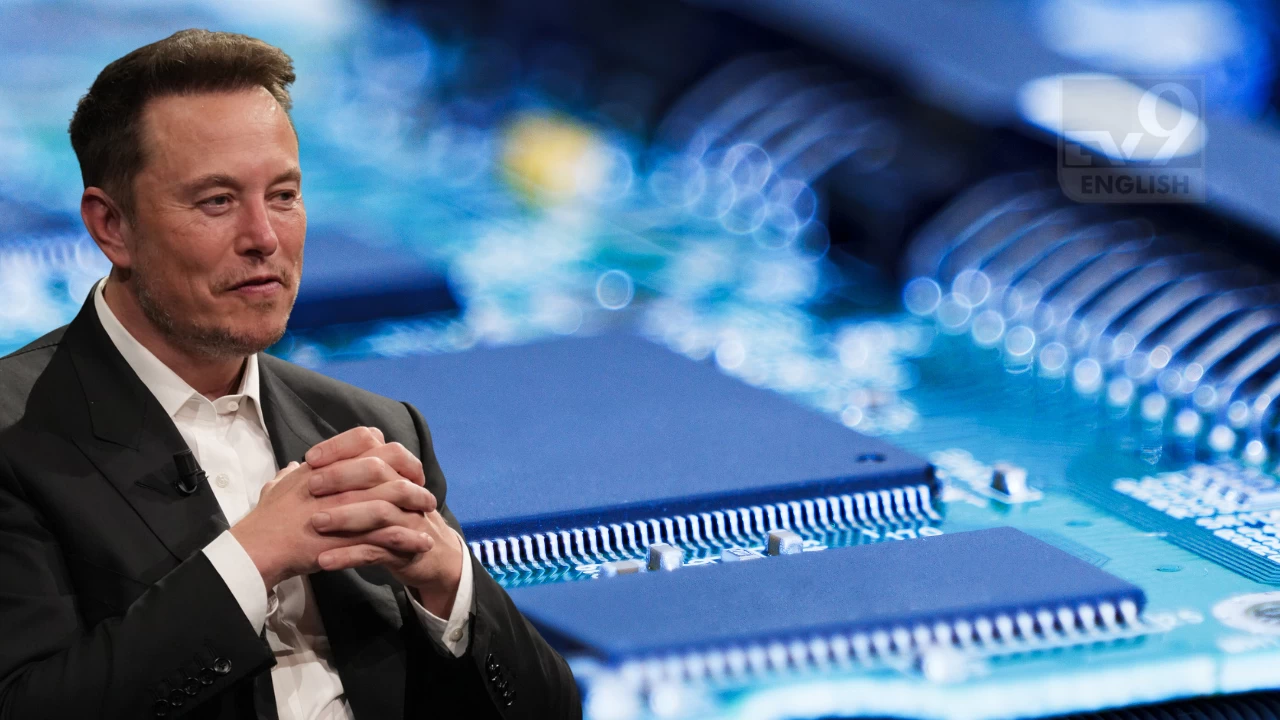

The long-rumoured deal was confirmed on Monday when Tesla CEO Elon Musk said on X, “Samsung's giant new Texas fab will be dedicated to making Tesla's next-generation AI6 chip. The strategic importance of this is hard to overstate.” The announcement follows a Bloomberg News report and was later supported by Reuters, citing three sources who confirmed Tesla is indeed the client.

The 22.8 trillion won contract runs till the end of 2033. Samsung had previously revealed the size and scope of the deal, but without naming Tesla, citing confidentiality. The confirmation from Musk not only settles the speculation but also puts a spotlight on Samsung’s chip manufacturing troubles.

Samsung’s chipmaking business has been under pressure. Despite being one of the biggest memory chip producers globally, its foundry division has failed to attract enough major clients. This led to underutilised capacity and delayed progress at its Texas fab. The factory’s construction and operational timeline were pushed to 2026. Now, with Tesla on board, there’s a clear chance for Samsung to turn that around.

“Samsung agreed to allow Tesla to assist in maximizing manufacturing efficiency. This is a critical point, as I will walk the line personally to accelerate the pace of progress. And the fab is conveniently located not far from my house,” Musk said on X. He added that he has been authorised by Samsung to assist in optimising production directly.

The AI chip segment is heating up, and the race is being led by the likes of Taiwan Semiconductor Manufacturing Co. (TSMC) and SK Hynix. According to TrendForce, TSMC commanded 67.6 percent of the global foundry market in Q1 2025, while Samsung's share dropped to 7.7 percent, down from 8.1 percent in the previous quarter.

“This will help a lot,” said Vey-Sern Ling, Managing Director at Union Bancaire Privee in Singapore, as quoted by Bloomberg. “Tesla’s business may also help them to attract other customers.”

Shares of Samsung jumped over 5 percent on the Korea Exchange after Musk’s announcement, hitting their highest level since September. That’s a clear sign of investor relief, especially with the foundry unit posting losses for several quarters.

Samsung had poured significant investment into the Taylor, Texas, facility. But without big-ticket customers, progress had slowed. Now, Musk’s involvement could push things forward. His close proximity to the plant, as he mentioned in his post, could mean a more hands-on approach.

The chip supply agreement comes at a time when South Korea is also seeking stronger trade ties with the United States. The country has been in talks to reduce or remove a proposed 25 percent tariff on exports like semiconductors and shipbuilding materials. A long-term chip deal with an American EV giant may play a role in that broader economic conversation.

For Tesla, the deal ensures a steady and high-performance chip supply chain in the United States. It also reflects the company’s growing push into developing its own AI chips, instead of relying on external suppliers like Nvidia. The AI6 chip is expected to power upcoming Tesla vehicles and AI projects.

So far, Tesla hasn’t disclosed full details about the AI6 chip, but the scale of the order suggests the chip is key to its future.