By signing in or creating an account, you agree with Associated Broadcasting Company's Terms & Conditions and Privacy Policy.

By signing in or creating an account, you agree with Associated Broadcasting Company's Terms & Conditions and Privacy Policy.

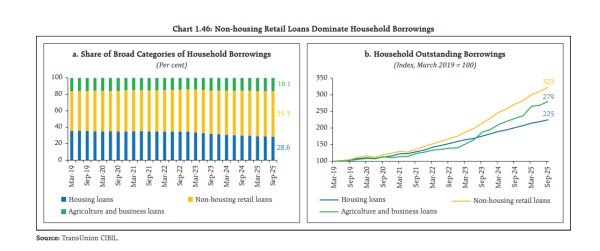

New Delhi: The Reserve Bank of India (RBI) has stated in the latest Financial Stability Report (FSR) that India's household debt jumped to 41.3 percent of gross domestic product at the end of March 2025, while non-housing retail loans accounted for 55.3 per cent of household borrowings in the first half of FY26. The RBI mentioned that household borrowing patterns showed a steady increase above its five-year average with non-housing retail loans, largely taken for consumption, accounting for 55.3% of total household borrowing from financial institutions as of September 2025.

“The Household debt stood at 41.3 per cent of GDP as at end-March 2025, marking a sustained increase compared to its 5-year average of 38.3 per cent,” the RBI said.

Among broad categories of household borrowings, non-housing retail loans extended mostly for consumption purposes continue to be the dominant segment, accounting for 55.3 per cent of total household borrowing from financial institutions as of September 2025.

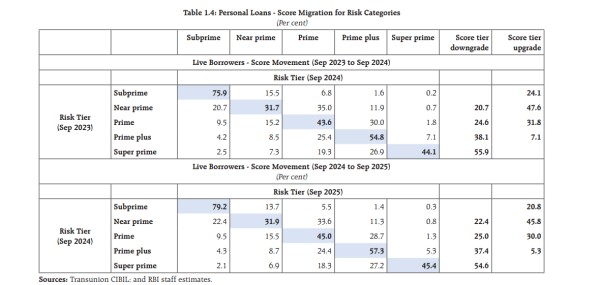

The share of non-housing retail loans has jumped over the years, with growth consistently surpassing that of housing loans, and agriculture and business loans. “From a risk perspective, the share of better-rated customers, viz., prime and above, has increased both in terms of the outstanding amount and number of borrowers, indicating that the overall resilience of the household sector remains sound,” the Financial Stability Report mentioned.

The report stated that the decomposition of household borrowings shows a dominant share of loans taken for consumption purposes followed by asset creation and productive purposes. The growth rate of these loans has moderated. The risk profile of borrowers availing loans for consumption and productive purposes has shown improvement, with the share of prime and above borrowers in outstanding loans showing an increasing trend.

Personal loans formed 22.3 per cent of consumption purpose loans as at the first half of 2025-26. The risk-tier migration matrix for personal loans showed that maximum borrowers retained their risk tier categories in the September 2024-2025 period as compared in the September 2023-2024 period.

The Net household financial savings improved to 7.6 per cent of GDP in Q4 of 2024-25. The increase was a result of a jump in rise in financial assets and stabilisation of liabilities while stock of gross financial assets remained steady above 100 per cent of GDP.

“As per the latest data, growth in the financial wealth of households moderated, reflecting a correction in equity and investment funds,” the RBI report stated.

Story Source: RBI Financial Stability Report (FSR)