By signing in or creating an account, you agree with Associated Broadcasting Company's Terms & Conditions and Privacy Policy.

By signing in or creating an account, you agree with Associated Broadcasting Company's Terms & Conditions and Privacy Policy.

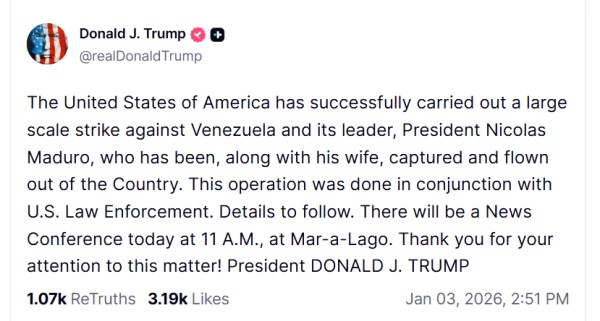

New Delhi: A long-simmering crisis between US and Venezuela has now turned into open military action. The United States has carried out strikes in Venezuela’s capital, Caracas, targeting the residence of the defence minister and key naval installations. As part of a large-scale operation, President Nicolas Maduro and his wife have been captured and flown out of the country. US President Donald Trump confirmed the operation on his social media platform, Truth Social.

Maduro has repeatedly alleged that Washington’s real objective is control over Venezuela’s vast oil reserves. US officials, however, counter this by claiming that the Maduro regime is deeply linked to drug trafficking networks and that his removal is critical to safeguarding American oil interests.

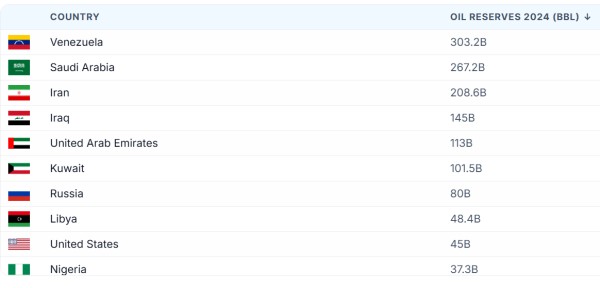

This escalation has once again raised a crucial question: how will military action in a country with the world’s largest oil reserves impact global crude oil prices? To understand this, it is essential to look closely at Venezuela’s oil economy and its place in the global energy market

Venezuela sits at the top of the global oil reserve rankings. The country holds an estimated 303 billion barrels of proven oil reserves- the highest in the world. Saudi Arabia follows with around 267 billion barrels, while Iran ranks third with approximately 208 billion barrels.

Most of Venezuela’s oil reserves are located in the eastern Orinoco Belt. Despite the scale of these resources, oil production has been declining for years. In the 1970s and 1990s, Venezuela produced between 2.5 and 3 million barrels per day. Over the past two decades, however, output has collapsed due to mismanagement, nationalisation, lack of investment, and international sanctions.

The impact of this decline is visible in trade numbers. In 2023, Venezuela’s total crude oil exports stood at just $4.05 billion, compared to $181 billion for Saudi Arabia and $125 billion for the United States in the same year.

Oil remains the backbone of Venezuela’s economy. It is the country’s primary export and contributes nearly 12 per cent of national income. However, the sharp fall in global oil prices- Brent crude dropped by nearly 20 per cent in 2025- has dealt a severe blow to Venezuela’s already fragile revenues.

US sanctions have further disrupted Venezuela’s oil trade with China and other buyers. According to a Reuters report, these restrictions could cost Venezuela up to $4.9 billion in revenue, roughly 10 per cent of its GDP.

India, China and Cuba were once among Venezuela’s key oil buyers. In June 2024, India imported around 22 million barrels of Venezuelan crude, accounting for just 0.92 per cent of its total oil imports. Since then, under growing US pressure, India’s oil trade with Venezuela has almost come to a halt.

Whenever tensions rise in a major oil-producing country, fears of supply disruption quickly ripple through global markets. Even when overall supply remains adequate, the perceived risk, often described as a “risk premium”, tends to push prices higher.

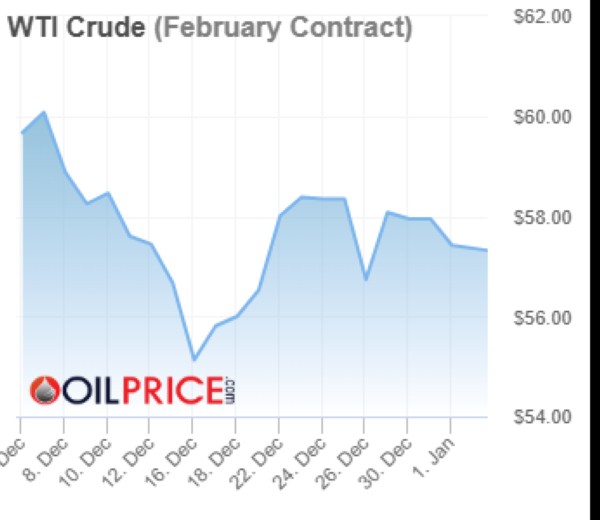

In recent months, global oil prices had fallen to near five-year lows, driven by weak demand and excess supply. However, after the Trump administration imposed restrictions on Venezuelan oil vessels in December 2025, US crude futures jumped 1.3 per cent to $55.99 per barrel.

As tensions escalated further, Brent crude rose to $61.03 per barrel in early January 2026, while WTI climbed to $57.59.

Currently, Brent crude is trading around $61 per barrel, and WTI around $57 per barrel. Despite production cuts by OPEC+, both benchmarks fell nearly 20 per cent in 2025 due to uncertain demand. With global consumption growth still unclear, geopolitical shocks— such as the Venezuela crisis— are now the primary drivers of upward price movement.

In March 2025, Trump had threatened steep tariffs on countries importing Venezuelan oil, pushing Brent crude up to $73.79 per barrel. The episode underscored how quickly prices rise when markets anticipate supply disruptions.

Current prices: As of January 2026, Brent crude is trading near $61 per barrel, while US WTI crude is around $57.6 per barrel.

Recent performance: In 2025, both benchmarks recorded their sharpest annual decline since the 2020 pandemic, falling nearly 20 per cent. In December 2025, hopes of progress in Russia–Ukraine peace talks briefly pushed oil prices down to five-year lows of $54–55 per barrel. That decline was short-lived, as renewed US enforcement actions, such as the seizure of sanctioned oil tankers, reignited upward pressure.

Trend: Over recent months, oil prices have been driven largely by OPEC+ decisions, demand uncertainty, and geopolitical flashpoints. While oversupply continues to weigh on the market, political risk remains a powerful counterforce.

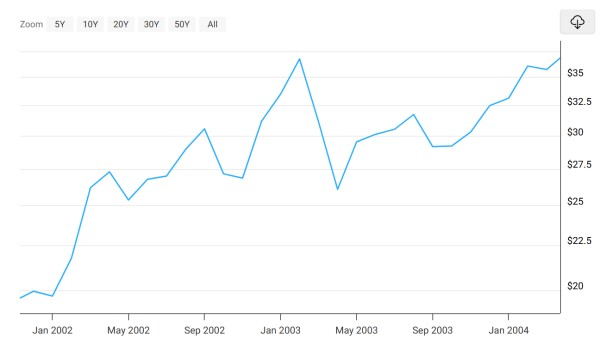

The link between war and oil prices is well established. Iraq provides one of the clearest examples. In 2003, the US-led invasion toppled President Saddam Hussein.

Before the war, Iraq produced about 2.5 million barrels per day. As the prospect of conflict grew in 2002–03, oil prices climbed beyond $30 per barrel.

After the invasion, production suffered for years due to pipeline attacks, political instability and internal conflict. By 2008, oil prices surged to nearly $140 per barrel, driven by both supply disruptions and rising global demand.

Iran offers a similar lesson. In 2018, after the US withdrew from the Iran nuclear deal and reinstated sanctions, Iranian oil effectively disappeared from large parts of the global market, tightening supply and pushing prices higher.

More recently, the conflict between Iran and Israel has reinforced this pattern. In June 2025, reports of Israeli strikes on Iran caused crude prices to jump 7 per cent, with Brent touching $74.23 per barrel.

These episodes show that when key oil producers or supply routes come under threat, markets react swiftly, and the impact is felt worldwide.

India has historically imported Venezuelan crude because its refineries are well suited to processing heavy oil. In 2024, India imported approximately 22 million barrels of crude from Venezuela, accounting for 0.92 per cent of total imports.

However, growing US pressure has sharply curtailed this trade. While India has compensated by increasing imports from Russia and the Middle East, Venezuelan oil is now largely absent from its supply mix.

Given that India sources most of its oil from West Asia and Russia, the immediate impact on domestic energy supply remains limited. The broader concern, however, lies in global price movements, any sustained rise in crude prices would directly affect India’s import bill and fuel inflation.