By signing in or creating an account, you agree with Associated Broadcasting Company's Terms & Conditions and Privacy Policy.

By signing in or creating an account, you agree with Associated Broadcasting Company's Terms & Conditions and Privacy Policy.

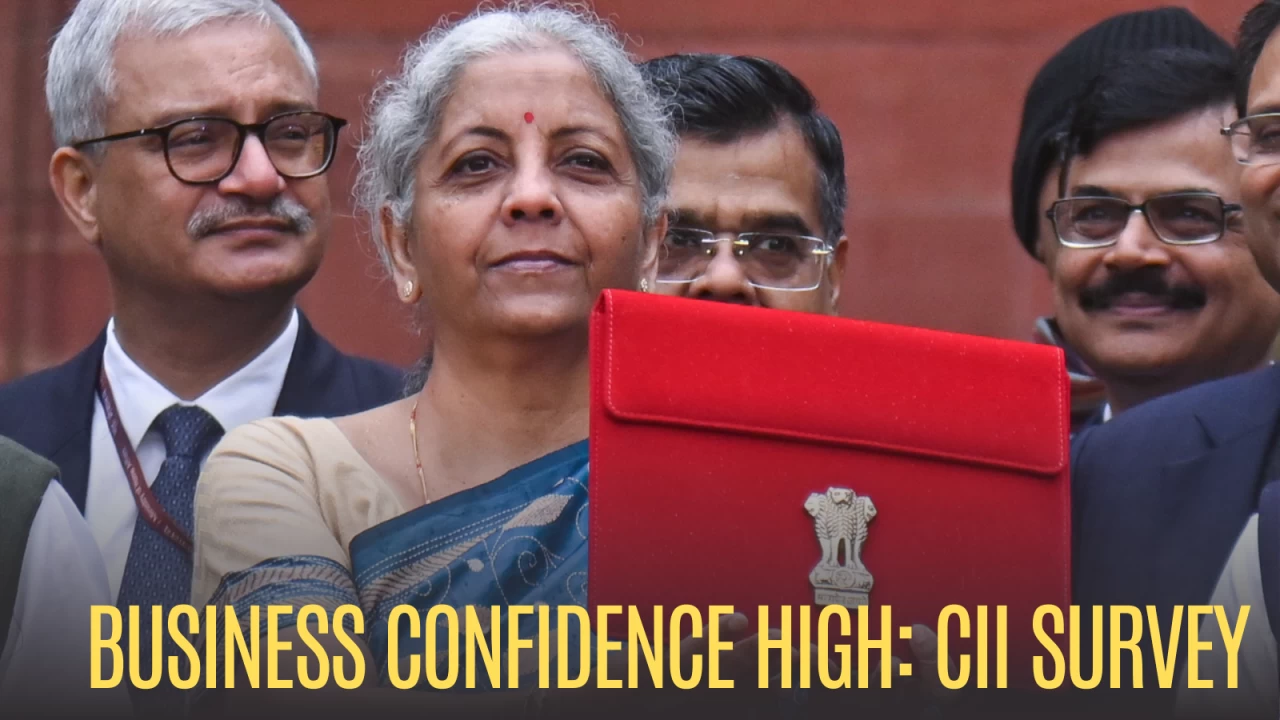

Kolkata: With finance minister Nirmala Sitharaman on Sunday (February 1) ready to present Union Budget 2026 in a few minutes, there are a lot of questions on the lips of the citizens. Will there be income tax relief this year too? Will the govt continue its focus on capital expenditure and building of infrastructure? Will she announce steps to create a large number of jobs?

Today is Sunday. This is just the second time in the country that the Union budget will be presented in Parliament on a Sunday. The first time such a thing happened was in 1999. Also this will be the ninth budget for Sitharaman and she is just one budget away from equaling Morarji Desai’s record of 10 budget presentations.

Continuing the focus on consumption is one of the primary focus areas of the FM. She tried sincerely in the Budget of 2025. and offered significant income tax relief. As an outcome, an individual who earns up to Rs 12.75 lakh a year won’t have too pay any income tax at all in the new tax system -- Rs 12 lakh plus the Rs 75,000 standard deduction. In September the GST reform offered another trigger to consumption. RBI relaxed the Repo rate by 125 basis points to bring down the cost of borrowing significantly to boost consumption.

Those measures mentioned above by both the govt and RBI revived consumption to some extent both in the urban and rural sectors. This year, the FM has to further stoke the fire. Analysts are unanimous in their opinion that the FM has to maintain the thrust on capital expenditure. This will serve the dual purpose of creating economic assets and creating jobs.

India Inc is expecting that the FM will perform a GST-style operation on customs duties which happens to be multi-layered and complex. The renewable energy sector expects that it will get a major fillip. The govt should be extend various schemes as well as bring certain sectors under PLI to give this promising sector a push, analysts are saying.

There is no major expectation of income tax relief. However, there are two expectations. One, standard deduction should be expanded to Rs 1 lakh from Rs 75,000 now. Many also demanding that the government should at least allow deductions on home loans in the new tax system.