By signing in or creating an account, you agree with Associated Broadcasting Company's Terms & Conditions and Privacy Policy.

By signing in or creating an account, you agree with Associated Broadcasting Company's Terms & Conditions and Privacy Policy.

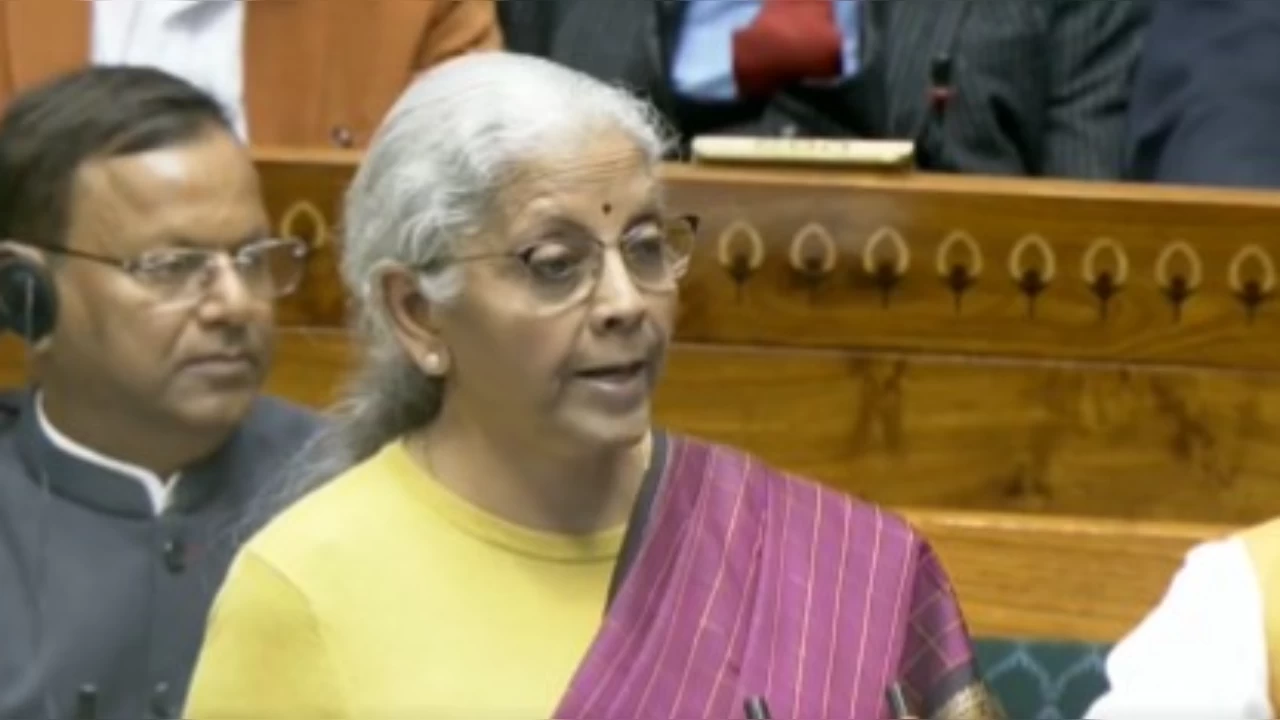

New Delhi: Union Finance Minister Nirmala Sitharaman, while presenting the Union Budget 2026 on February 1, announced several proposals on direct taxes to ensure the common people's ‘Ease of living’. During the Budget presentation, FM Sitharaman outlined its three ‘kartavya’, which are driving growth, empowering people, and ensuring inclusive development aligned with ‘Sabka Saath, Sabka Vikas’.

FM Sitharaman proposed in the Budget that any interest awarded by the Motor Accident Claims Tribunal to a natural person would not come under the ambit of Income Tax. Also, there won't be any TDS on this account.

The Budget proposes to reduce the TCS rate on the sale of overseas tour program packages from the current 5 per cent and 20 per cent to 2 per cent without any stipulation of amount. For Ease of doing business, those who are Resident Outside India (PROIs) will be allowed to invest in equity instruments of listed Indian companies through the Portfolio Investment Scheme (PIS).

Also, under the Liberalised Remittance Scheme (LRS), it aims to bring down the TCS rate for pursuing education and for medical purposes from 5 per cent to 2 per cent. Supply of manpower services is proposed to be specifically brought within the ambit of payment to contractors for the purpose of TDS to avoid ambiguity. Thus, TDS on these services will be at the rate of either 1 per cent or 2 per cent only.

FM Sitharaman proposed in the Budget scheme for small taxpayers is where a rule-based automated process will help them to get a lower or nil deduction certificate. It will enable them to avoid the hassle of filing an application with the assessing officer. For the ease of taxpayers holding securities in multiple companies, the budget proposes to enable depositories to accept Form 15G or Form 15H from the investor and provide it directly to various relevant companies.

To address practical issues of small taxpayers like students, young professionals, tech employees, relocated NRIs, and such others, it aims to introduce a one-time 6-month foreign asset disclosure scheme for these taxpayers to disclose income or assets below a certain size. This scheme would be applicable for two categories of taxpayers, namely, (A) those who did not disclose their overseas income or assets and (B) those who disclosed their overseas income and/or paid due tax, but could not declare the assets acquired.

The Budget addressed practical issues of small taxpayers like students and young professionals by aiming to introduce a one-time 6-month foreign asset disclosure scheme. It will enable them to disclose income or assets below a certain size.

It can be done by only those taxpayers who did not disclose their overseas income or assets, and those who disclosed their overseas income and/or paid due tax, but could not declare the assets acquired. The limit of undisclosed assets of the first category is up to Rs 1 crore, and for the second category, the maximum asset value is proposed at Rs 5 crore. Also, immunity from both penalty and prosecution will be available for a fee of Rs 1 lakh.

The deadline for revising returns has been extended from December 31 to March 31 with the payment of a nominal fee. Also, people with ITR 1 and ITR 2 returns will continue to file till July 31, and non-audit business cases or trusts will get time till August 31. TDS on the sale of immovable property by a non-resident is proposed to be deducted and deposited through the resident buyer’s PAN-based challan instead of requiring a TAN.