By signing in or creating an account, you agree with Associated Broadcasting Company's Terms & Conditions and Privacy Policy.

By signing in or creating an account, you agree with Associated Broadcasting Company's Terms & Conditions and Privacy Policy.

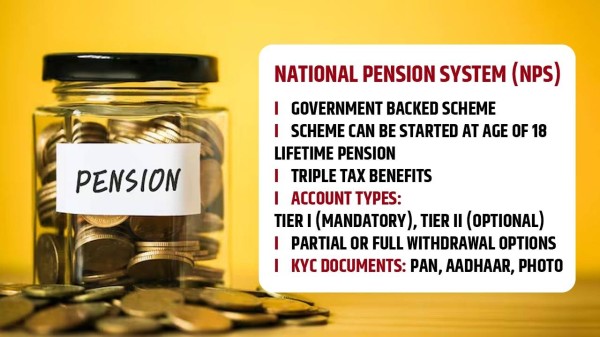

New Delhi: The Pension Fund Regulatory and Development Authority (PFRDA) has released a draft proposal calling for amendments on exits and withdrawals for National Pension System (NPS) scheme. One of the very key proposals is that subscribers have the option to exit after 15 years, rather than having to wait until they turn 60 or retire.

“Enhancement of permissible limit for lumpsum withdrawal by subscribers, where the accumulated pension wealth is below the specified threshold,” the proposed draft mentioned.

The draft also proposes that subscribers should have the option to make a number of times of partial withdrawals from their NPS corpus. As per the scheme rules, the portion of the NPS corpus is mandatorily required to be set aside for purchasing an annuity, and more.

The proposed amendments to Pension Fund Regulatory and Development Authority (Exits and Withdrawals under the National Pension System) Regulations, 2015, calls for redrafting of definition of ‘Exit’, including exit from NPS Vatsalya, schemes of Pension Funds being introduced for non-government sector.

The proposed draft states that exit provisions should be included in respect of schemes of Pension Funds being introduced for the non-government sector.

The proposal calls for enhancement of the proportion of lumpsum withdrawal by non-government sector subscribers upon attaining age of 60 years/retirement. Removal of vesting period for normal exit in cases where individuals join NPS after 60 years of age.

The draft also advocates for increasing the age limit for entry into and exit from NPS, with automatic continuation.

The NPS reforms draft proposal also mentions the need for the introduction of option to avail systematic unit redemption in cases where accumulated pension wealth is below the specified threshold.