By signing in or creating an account, you agree with Associated Broadcasting Company's Terms & Conditions and Privacy Policy.

By signing in or creating an account, you agree with Associated Broadcasting Company's Terms & Conditions and Privacy Policy.

New Delhi: Gold has become the talk of the town - All thanks to the stupendous increase in its prices in 2025. However, with the present year coming to end, let’s have a look at the prospects of Gold in the upcoming year - 2026. The precious yellow metal delivered superb returns and became one of the best performing asset classes, surging around 60 per cent this year so far. The skyrocketing price of Gold rally was backed by lower opportunity cost of holding gold, safe haven appeal and robust demand.

Axis Mutual Fund has released its report on the future of Gold.

The brokerage house mentioned that the lower interest rates is good for the yellow metal. “Lower interest rate trajectory in the US bodes well for gold as it reduces the opportunity cost of holding the non-yielding asset. We anticipate 1-2 more rate cuts in this cycle, as macroeconomic conditions stay uneven and weakness persists in the labour market,” the report stated.

There are concerns about the Federal Reserve’s independence due to US President Donald Trump’s stance on incumbent Fed chief Jerome Powell. The report projected that if the new Chair is aligned with Trump’s policy preferences, markets would anticipate a dovish stance, which may provide additional support for gold.

The brokerage firm said With US debt to GDP at 124%, concerns on the government debt levels have weighed on the US Dollar. The weakening of the US Dollar index in 2025 so far has worked in favour of gold, it added.

The brokerage projected that the factors which fuelled gold price rally in 2025 may continue to provide support. The firm cautioned the investors to be mindful of potential headwinds that may temper the momentum.

“Higher real yields, a stronger US dollar, higher global growth, reduced inflationary pressures, and hawkish US policy stance may erode demand,” it stated.

The report further cautioned that profit-taking, reduced ETF inflows, commodity rotation into industrial metals and easing geopolitical risks could also weigh on the gold prices.

Note: Foreign official holdings of Treasuries data up to end July 2025. Source: US Treasury, IMF, Bloomberg, Jefferies

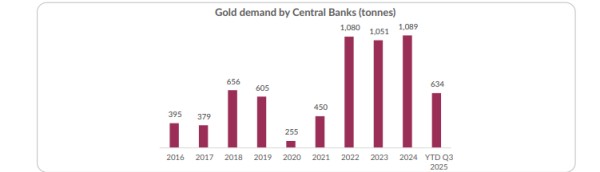

Overall, while gold retains long term support from persistent Central Banks’ purchases and safe haven demand, 2026 may bring bouts of correction and volatility. However, in the near term, we have a positive bias on gold, supported by safe haven flows given the backdrop of global uncertainty,” the brokerage mentioned.

(Disclaimer: This article is only meant to provide information. TV9 does not recommend buying or selling shares or subscriptions of any IPO, Mutual Funds, gold, silver and crypto assets.)